MREITs

Mortgage Real Estate Investment Trusts, also known as Mortgage REITs or MREITs, are companies that, like their Equity REIT cousins, were made possible through legislation passed by Congress in 1960 to help enable individuals from all walks of life to gain the benefits of investment in real estate debt and equity.

Congress specifically noted that these beneficial characteristics include “greater diversification of investment,” “expert investment counsel” and the means of “collectively financing projects which the investors could not undertake singly.”

A key part of the original REIT legislation requires REITs to distribute most of their income each year to their shareholders in the form of dividends. REITs are permitted to deduct from their corporate taxable income every dollar they pay out, while shareholders pay tax on the dividend income they receive, generally at ordinary income tax rates. This dividend distribution requirement is fundamental to the ability of REITs to deliver the continuing income and performance benefits characteristic of real estate debt and equity investment.

The Mortgage REIT industry: a diverse marketplace

There are two main types of REITs, generally referred to as Mortgage REITs and Equity REITs. Mortgage REITs provide financing for real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments, while Equity REITs invest in real estate equity by acquiring properties – such as shopping malls, office buildings or apartments – and collecting rents from their tenants.

Mortgage REITs invest in residential and commercial mortgages, as well as residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS). Mortgage REITs typically focus on either the residential or commercial mortgage markets, although some invest in both RMBS and CMBS.

Most residential Mortgage REITs invest in “agency” RMBS, which are issued by Fannie Mae and Freddie Mac, often referred to as U.S. government-sponsored enterprises (GSEs), or Ginnie Mae. Agency RMBS constitute the bulk of assets held by Mortgage REITs today. However, residential Mortgage REITs also may invest in RMBS issued by other financial institutions (non-agency or private-label RMBS) and residential mortgage loans.

Commercial Mortgage REITs provide financing for commercial real estate. They may invest in commercial mortgages and commercial real estate loans, as well as both rated and unrated CMBS, mezzanine loans, subordinated securities or construction loans, and may participate in loan securitizations.

Mortgage REITs are typically listed on the NYSE or NASDAQ, allowing a wide range of investors, including individual investors as well as institutions, to purchase shares of their equity securities. Stock exchange-listed Mortgage REITs provide a simple way to hold an equity investment in the mortgage market with the liquidity and transparency of publicly traded equities – advantages not available through direct investment in mortgage loans and mortgage-backed securities. As of Dec. 31, 2013, there were 26 listed residential Mortgage REITs with a market capitalization of $42.3 billion and 19 listed commercial Mortgage REITs with a market capitalization of $19.7 billion.

There are other Mortgage REITs whose shares are registered with the SEC but are not listed on any stock exchange. These public non-listed REITs (PNLRs) are typically sold to investors by a broker or financial advisor. Mortgage REITs also can be privately held.

The Mortgage REIT business model

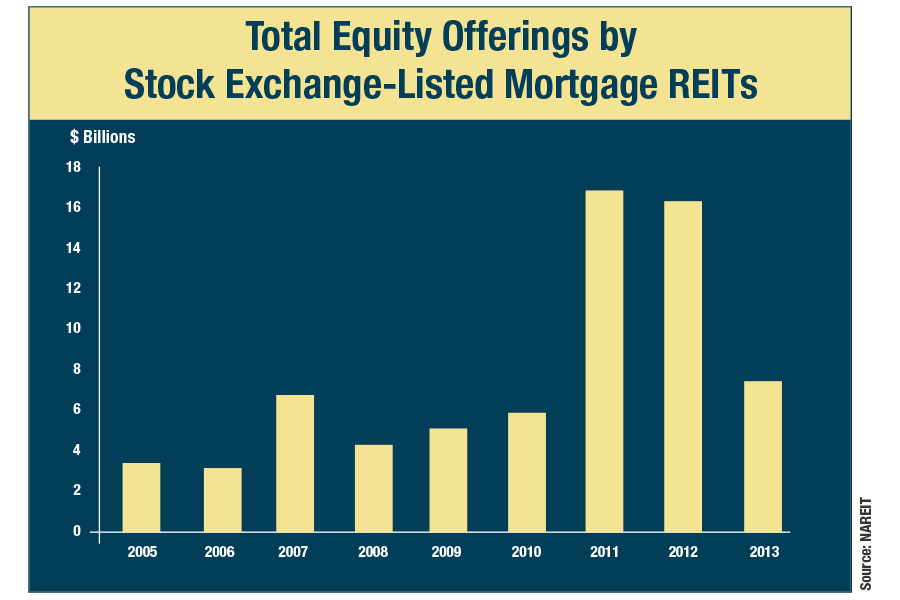

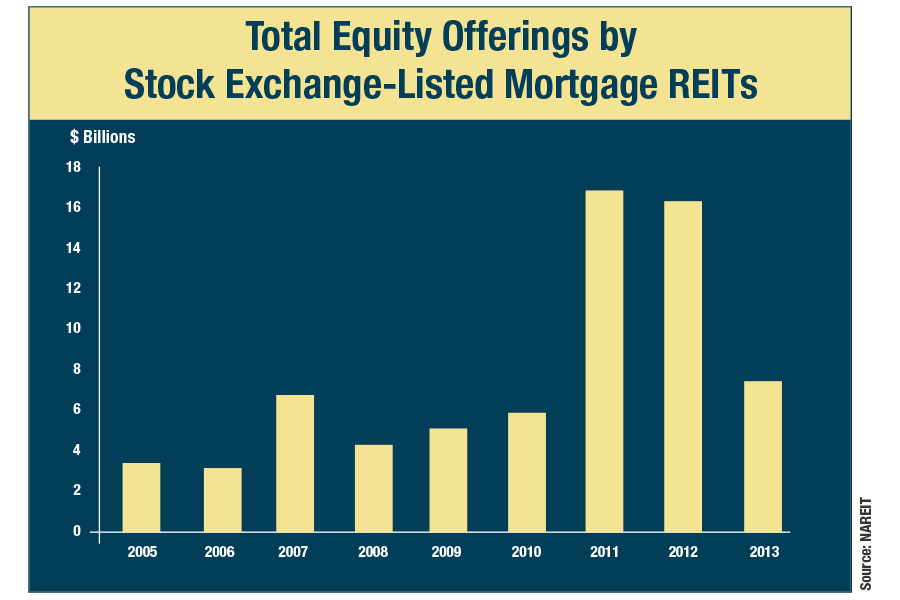

Mortgage REITs hold mortgages and MBS on their balance sheets, and fund these investments with equity and debt capital. Their general objective is to earn a profit from their net interest margin, that is, the spread between interest income on their mortgage assets and their funding costs. Mortgage REITs rely on a variety of funding sources, including common and preferred equity, repurchase agreements, structured financing, convertible and long-term debt, and other credit facilities. Mortgage REITs raise both debt and equity in the public capital markets. Mortgage REITs raised $16.2 billion in total equity offerings in 2012 and $7.3 billion in 2013.

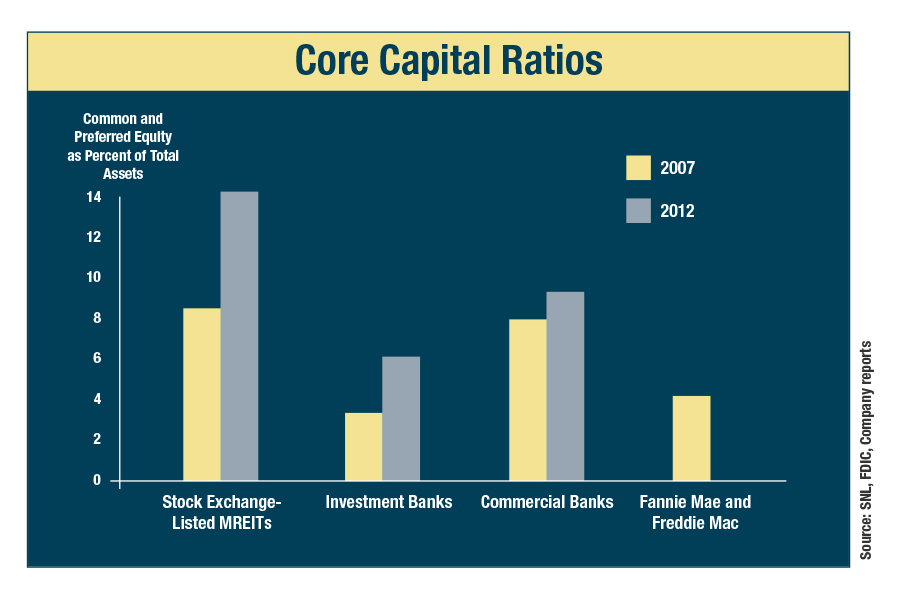

Mortgage REITs typically use less borrowing and more equity capital to finance their acquisitions of mortgages and MBS than do other large mortgage investors. At the end of 2012, the asset weighted average equity capital ratio of all stock exchange-listed Mortgage REITs was 14.2 percent, compared to 9.3 percent for the commercial banking industry and 6.2 percent for the investment banking industry. Mortgage REITs were also typically better capitalized than other mortgage investors in the period before the 2008 financial crisis.

Investing in Mortgage REITs

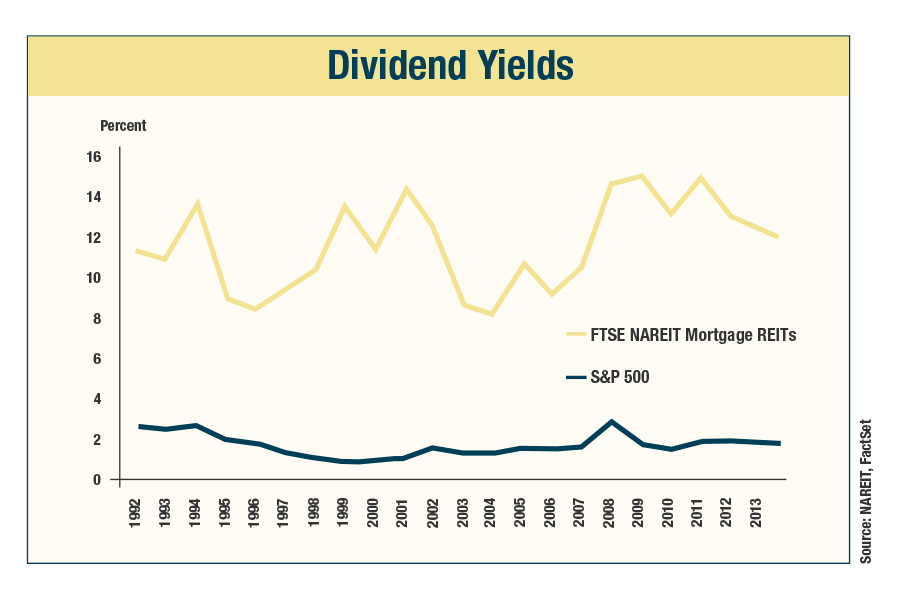

Investors typically find value in Mortgage REITs primarily because of their relatively high dividends.

There are several ways to invest in Mortgage REITs. Investors can purchase common or preferred shares of individual stock exchange-listed MREITs, most of which are traded on major stock exchanges like the NYSE or NASDAQ. Direct purchases provide the liquidity of publicly traded securities as well as the ability to choose which individual REITs to include in the investor’s portfolio. Alternatively, investors can purchase shares in a mutual fund that focuses on Mortgage REITs. This strategy helps provide diversification across the entire sector while still allowing sales and exchanges on an end-of-day basis. Investors can also purchase shares in a Mortgage REIT exchange-traded fund (ETF), which provides additional liquidity through the ability to buy or sell shares during the trading day.

Each of these strategies – direct purchases of shares of individual Mortgage REITs, investing through a Mortgage REIT mutual fund or through a Mortgage REIT ETF – allows investors to hold an equity investment in the residential and commercial mortgage markets.

Risks and risk management

The business risks that Mortgage REITs face are similar to those of other financial firms. Mortgage REITs have considerable experience managing many types of risk:

Interest Rate Risk. Managing the effects of changes in short- and long-term interest rates is an essential element of Mortgage REITs’ business operations. Changes in interest rates can affect the net interest margin, which is Mortgage REITs’ fundamental source of earnings, but also may affect the value of their mortgage assets, which affects corporate net worth.

Mortgage REITs typically manage and mitigate risk associated with their short-term borrowings through conventional, widely-used hedging strategies, including interest rate swaps, swaptions, interest rate collars, caps or floors and other financial futures contracts. Mortgage REITs also manage risk in other ways, such as adjusting the average maturities on their assets as well as their borrowings and selling assets during periods of interest rate volatility to raise cash or reduce borrowings.

Credit Risk. The bulk of mortgage securities purchased by residential Mortgage REITs are agency securities backed by the federal government, which present limited credit risk. Commercial Mortgage REITs may be exposed to credit risk through their private-label RMBS and CMBS. The degree of credit risk for a particular security depends on the credit performance of the underlying loans, the structure of the security (that is, which classes of security are paid first, and which are paid later), and by the degree of over-collateralization (in which the face amount of the mortgage loans held as collateral exceeds the face amount of the RMBS or CMBS issued).

Prepayment and rollover risks.

Prepayment. Changes in interest rates or borrower home sales affect the probability that some borrowers will refinance or repay their mortgages. When such a refinancing or repayment occurs, the investor holding the mortgage or MBS must reinvest the proceeds into the prevailing interest rate environment, which may be lower or higher. Mortgage REITs seek to hedge prepayment risk using similar tools and techniques as those they use to hedge against interest rate risks.

Rollover. Mortgage REIT assets are mainly longer-term MBS and mortgages, while their liabilities may include a significant amount of short-term debt, especially among residential Mortgage REITs. This term mismatch requires that they roll over their short-term debt before the maturity of their assets. Their ability to do so depends on the liquidity and smooth functioning of the short-term debt markets, including the repo market. The repo market is extremely liquid, with an estimated $2 trillion in outstandings and several hundred billion dollars in daily trading volume. Banks and dealers also use the repo market as an important source of market liquidity. In the financing markets, the liquidity of the agency MBS and TBA (To Be Announced) markets is comparable to the market for Treasuries. Commercial Mortgage REITs tend to match the duration of their assets and liabilities and face little rollover risk.

Benefits to homeowners, businesses and financial markets

Mortgage REITs provide funding for mortgage credit for both homeowners and businesses. By using private capital to buy residential mortgages and mortgage backed securities (RMBS), Mortgage REITs help provide liquidity and credit to home mortgage markets. Their financing activities have helped provide mortgage loans for 2.5 million homebuyers. Likewise, Mortgage REIT purchases of commercial mortgages and commercial mortgage-backed securities (CMBS) provide another source of mortgage credit for business investments in commercial real estate.

Mortgage REITs are positioned to play an important role in the post-financial crisis restructuring of the housing finance market. Most blueprints for mortgage market reform call for a significantly reduced role for Fannie Mae and Freddie Mac. Refinancing the mortgage loans and RMBS currently owned by the GSEs, as well as funding new mortgage originations for future homebuyers will require large sources of new capital, particularly as the GSEs and the Federal Reserve reduce their investment activities. Mortgage REITs have the ability to raise private capital without government guarantees or reliance on FDIC-insured bank deposits. Most Mortgage REITs are registered with the SEC and are required to publish regular financial statements for review and monitoring by investors and analysts. Through their ongoing provision of residential and commercial mortgage credit, Mortgage REITs continue to play an important role in the recovery of housing markets and overall economic growth.

You could definitely argue that this has already started to take place, as shares of WMC have jumped by 8.7% in the trailing 4 weeks. If that wasn’t enough, the company currently possesses a Zacks Rank #1 (Strong Buy), so it could have more room to run in the weeks ahead too.

More bullishness may especially be the case when investors consider what has been happening for WMC on the earnings estimate revision front lately. No estimate has gone lower in the past two months, compared to 3 higher, while the consensus estimate has also moved higher too.

So given this move in estimates, and the positive technical factors, investors may want to watch this breakout candidate closely for more gains in the near future.